In todays fast paced digital world in 2025 financial education will no longer be a matter of choice however its a must. The core of your financial identity is an unifying significant number credit scores. Your three digit score acts as your financial card that dictates your capacity to obtain loans apply for credit cards as well as influencing the cost of insurance.

Until recently accessing and understanding this vital measurement was an arduous cost intensive frequently expensive and often a swarm of spam. But the world is being transformed dramatically by the latest fintech innovation.

The most prominent example of this in India is OneScore credit Score App a revolutionary instrument created by FPL Technologies trusted by over 4 million Indians.

This is a comprehensive guide to everything that the OneScore Credit Score App can offer by 2025. This is more than an application; it’s an entire financial management platform that is designed to help you become more empowered.

In this article we will explore the dual benefits of this service: offering a lifelong free open and non-spam free method to keep track of your credits health as well as providing a streamlined system for getting instant personal loans at times when you need these loans the in the most urgent situations.

No matter if you’re just a recent graduated looking to increase your credit rating salaried professional who is planning to make a big purchase or someone who is looking to get their finances back in order.

This guide will teach how OneScore Credit Score app could be your most reliable all around partner. This article will examine the power of its features break down the loan options and discuss why it is an important tool for all those who is serious about financial security.

The First Pillar: Free and Transparent Credit Score Management

The premise of OneScore: Credit Score App is to simplify the world of scores for credit. It removes the mystery and gives users direct accessible nonbiased access to their personal financial health profile totally absolutely free and with no the irritation of advertisements or calls for promotional purposes.

Why Your Credit Score is Your Most Important Financial Metric

Before delve into the applications capabilities is essential to comprehend the meaning of a credit score and the reason it has such power. Imagine it as your report card for financial transactions. It’s a number usually ranging from 300 900 which informs lenders of how reliable you’re a lender. It is calculated by credit bureaus such as CIBIL and Experian in accordance with the credit history of you.

The most important factors that affect your score are:

- Pay History: Can you make payments on your EMIs as well as credit card debts punctually? This is a crucial element.

- Credit Utilization Ratio: How how much of your credit limit do you use? The lower the number the better.

- Credit Mix: A balanced mixture of secured loan (like car or home loans) as well as unsecured loans (like personal loans and credit cards) is considered to be a positive thing.

- The Age of the Credit History The longer your period of sound credit management can improve your score.

- Recent Credit Requests If you apply to obtain too many credit cards in the span of a few days can decrease your credit score.

By 2025 having a good credit rating (typically 730 or more) will allow you access to the top loans and financial options such as lower rates of interest for loans greater limit on credit cards as well as faster approvals. Low scores can prove to cause major problems. OneScore: Credit Score App is designed to place you in the driving control of this important score.

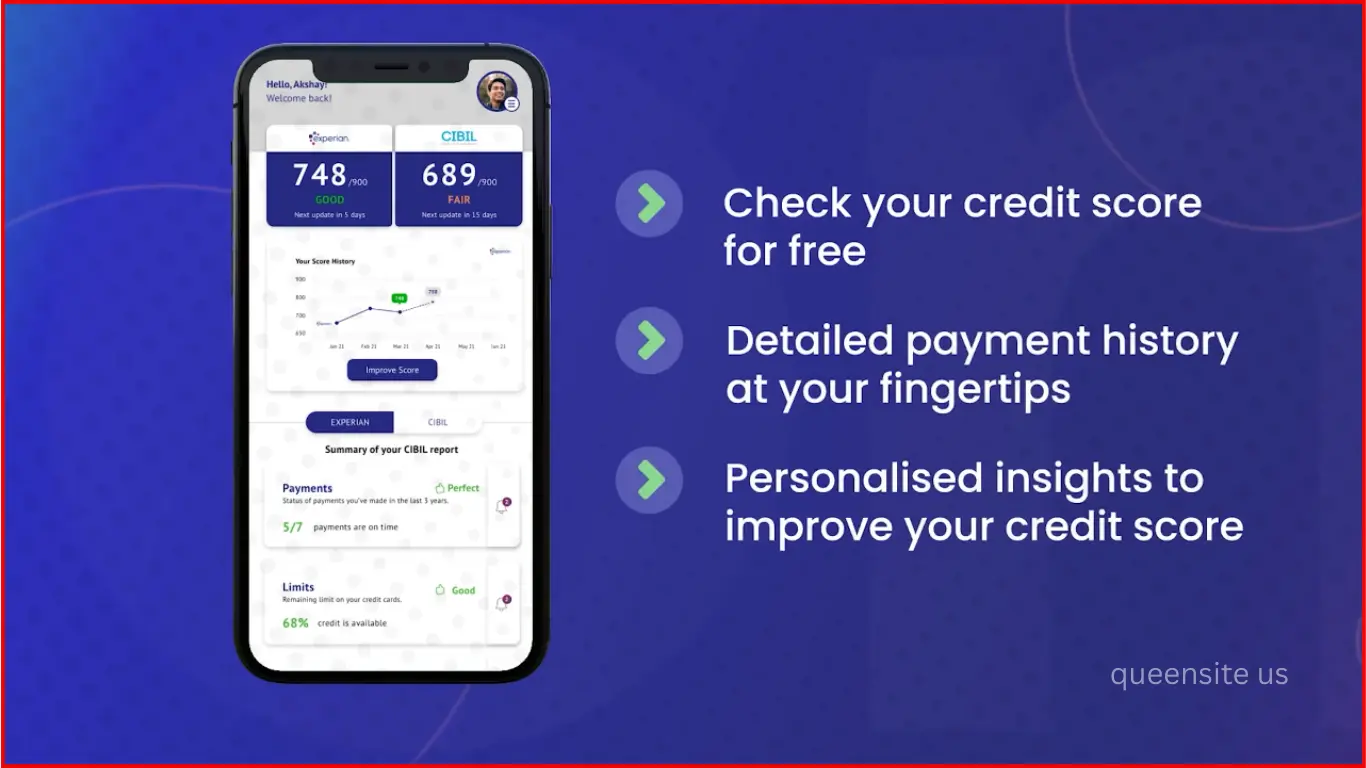

Accessing your CIBIL and Experian Score using OneScore

One of the most notable characteristics of the OneScore credit score app is the fact that it will provide the scores of both important credit bureaus within India: Experian and CIBIL. It is extremely useful because various lenders might use different bureaus when assessing your credit score. A complete profile will ensure that there will be no surprise.

It is extremely straightforward and secure

- Download the OneScore: Credit Score App.

- Enter your mobile number as well as your email address.

- Verify your identity by using your PAN card as well as your other data. This is required to obtain an accurate credit report.

Within a matter of minutes the app quickly retrieves and displays the most recent credit scores. It offers a life long free service that allows you to review and update your credit score whenever you’d like without any hidden costs. This promise to provide access for free is the main tenet of the OneScore Credit Score App concept.

Intelligent Features for Proactive Credit Management

OneScore: Credit Score App OneScore: Credit Score App is more than just showing the user a number. It offers a range of AI powered powerful instruments to help you better understand the importance of managing and improving your credit score.

- “Find out Why” feature The Find Out Why feature is one of the most useful methods. When your score is affected and you’re left wondering. It analyses your credit history and gives a concise easy to understand explanation of the change. Did you make a late payment? Did your credit utilization go up? This tool pinpoints the precise source which allows you to correct the issue.

- Score Planner: The program transforms credit management not a passive process but an active process. You are able to set a desired credit score that you want to attain. The OneScore Credit Score App then provides personalized information and an outline of steps you could do to get there. This is like having a personal credit advisor within your reach.

- Credit Score Simulator been curious about the impact of taking out a loan or closing an existing credit card could have an impact on your score? This simulator allows you to explore the possibilities. The user can enter a financial decision The app will show the likely effect on your Experian as well as CIBIL scores. This app is extremely useful to make informed financial choices and is an essential aspect of the OneScore credit Score App.

- A Comprehensive View of Your Account: This application consolidates your credit and loan accounts into one simple display. It provides a clear overview of all remaining balances due dates as well as credit limit eliminating having to manage numerous reports.

- Actual time error correction: Errors in your credit report can be far more prevalent than you believe and can affect your credit score. The OneScore credit Score App allows you to detect errors on your report and then report them in just a single click streamlined the process which was previously lengthy and bureaucratic.

Second Pillar: Instant and Transparent Personal Loans

Although a robust credit management system is its foundation OneScore credit Score App evolves from a monitor tool to become a comprehensive solution for financial management by integrating effortless transparent and easy to use instant personal loan application. It uses the information from your credit score to provide pre approved loans that are specifically tailored to your personal profile.

How to Avail an Instant Personal Loan on OneScore

The synergy that exists between monitoring your credit and lending is the reason that makes OneScore Credit Score App extremely effective. Through monitoring your score regularly and ensuring you have good financial habits within the ecosystem of the app and building your creditworthiness. The apps algorithm then validates your creditworthiness as a responsible borrower and provides you with tailored pre approved loans.

The process of application is created specifically for the age of digital and focuses on speed and ease of use:

- Quick Loan Payment: When granted the loan is quickly transferred into your bank account so it is ideal for emergencies that require cash.

- Simple Application: The whole procedure is completed in the application and requires only a couple of clicks to submit.

- They don’t require collateral. Personal loans are not secured by collateral which means you do not have to put up any asset such as gold or property.

- Zero Documentation: As the application already holds the KYC information and an accurate image of your credits health The need for cumbersome paper documents is gone.

Eligibility Criteria for the Best Loan Offers

Transparency is the key to success for a successful business and transparency is the key. OneScore credit Score App clearly outlines the conditions for eligibility to its most effective personal loans online:

- A credit score at 730 or higher The primary prerequisite. An excellent score indicates the history of a responsible lending pattern and can help you get the best rates.

- Stable job with monthly earnings greater than Rs.20000. Lenders require confirmation that you are earning an income that is steady for timely EMI payment.

- Aadhaar or PAN Holder: They must be present to finish the electronic KYC (Know Your Customer) procedure as per the regulatory guidelines.

If you fit these requirements If you meet these criteria, you will likely find attractive loans in the OneScore credit score app.

Deconstructing the Personal Loan Features and Costs

OneScore: Credit Score App has a partnership with reliable, and RBI approved lenders for the loan services. This assures the loan process is secure and strictly controlled.

- Lending Partners: Federal Bank South Indian Bank Kisetsu Saison Finance India (KSF)

- The amount of the loan: You are able to get loans of up to 5 Rs Lakh subject to the criteria you meet.

- Time to Pay: Loan tenures vary and can range from a minimum period of 6 months up to 4 years (4 year).

- Interest Rates: These rates are competitive and can vary according to the lender:

- Federal Bank: 12.5% 18.5%

- South Indian Bank (SIB): 15.9% 16.8%

- Kisetsu Saison Finance (KSF): 13.5% 29.99%

- Processing Fees: One time cost is incurred when the loan process is completed.

- Federal Bank: 1.5% 2.5% (Minimum Rs999)

- SIB: 1% + Rs750 Digital document charges + GST

- KSF: 1% 4%

- Annual Percentage Rate (APR) APR is what you pay for the loan for a calendar year which includes interest and charges. This gives a full overview of the loans costs.

- Federal Bank: 13.32% 27.49%

- SIB: 16.54% 20.52%

- KSF: 16% 42%

A Real-World Loan Calculation Example

In order to ensure transparentness to ensure total transparency OneScore: Credit Score App offers a simple explanation of how loans costs are estimated. Lets look at it in detail in order to understand it better:

If you decide to take out the personal loan amount in the amount of Rs50000 with a term of one calendar year (12 months) with the rate of interest 13 percent.

- Loan Amount (Principal): Rs50000

- Tenure: 12 months

- Inflation Rate 13% year

- Monthly EMI Amount: Your monthly Equated installment would be 4466. It is possible to verify this by through the EMI calculator that is available in the OneScore Credit Score app.

- Total Interest Payable: (EMI x Tenure) Principal = (Rs4466 x 12) Rs50000 = Rs53592 Rs50000 = Rs3592. This sums up the amount of amount of interest that youll pay throughout the course of.

- Processing Fees (incl. GST) If we assume a processing fee of ~2.36 percentage this amounts at 1179 rupees.

- Disbursed Amount: The total amount you receive in your bank account represents the amount of loan less processing fees that is Rs50000 divided by Rs1179. the amount of Rs48821.

- Total Sum Payable The total amount you’ll have to repay to the lender throughout the period: Principal plus Interest = Rs50000 plus 35992 = 53592. (Note that the example in the app also includes processing costs which will result in a total of an amount of Rs54771 and this can make it difficult to understand. The term “total payable” typically means principal plus interest).

- The total cost of a loan Total Cost of Loan: It is the total of the charges that you have to have to pay over the principal amount. For example Processing Fees + Interest = the sum of Rs3592 and Rs1179 equals Rs4771.

The app explains further the idea behind Broken Period Interest. This is a term that applies when there’s a gap that’s longer than normal between the date of your loans disbursal before your first EMI date. This degree of detail demonstrates the firm commitment of OneScore Credit Score App to fairness.

Download

Why OneScore Stands Out: The Key Differentiators

In the crowded market of fintech OneScore: Credit Score is a standout. OneScore: Credit Score App has created its own brand by adhering to a principle of a user first ethos. This is what makes it stand out.

A Spam Free and Ad Free Sanctuary

Its perhaps one of the best kept promises. It is a promise that’s refreshing. OneScore: Credit Score App ensures that your personal information is not given to marketers from third parties. The app will not send you a flurry of with unwanted calls or emails regarding loans that you did not ask for. The interface of the app is simple easy to use and without ads. The focus on the customer experience without the need for excessive ads is a key factor in its success.

Uncompromising Safety and Security

In the case of sensitive financial information security is a must. It is essential to protect your data. OneScore: Credit Score App has been built on the base of solid data security. It explicitly states that “None of your information is shared with any third party or institution. Your data is safe with us.” This guarantee ensures that all your financial and personal data are kept private and safe.

A True End to End Credit Management Tool

OneScore isn’t a utility that serves one function. Its an integrated platform. It is a one stop shop to manage the entire lifecycle of credit:

- Discover: Know your credit score and the variables that affect it.

- Monitor: Monitor your CIBIL as well as Experian scores at no cost.

- Make improvements: Use the Score Planner and Simulator to create a more favorable credit score.

- Use leverage when you need money you can leverage your good credit rating to get the most attractive instant loans.

The integrated method makes OneScore: Credit Score App an essential tool in modern day finance management.

User Centric Tools and Support

From the built in EMI calculator which helps in planning your repayments as well as the capability to create reminders for your payments to ensure you don’t have to miss a due date. each feature was created with user friendliness at heart. Furthermore, the app provides accessible customer support through its help email (onescorehelp@onescore.app) and a detailed website ensuring users can get assistance when needed.

Practical Information for 2025 Users

Anyone who wants to download and utilize the application for the first time here are some of the main tech details for September 20, 2025

- Current Version: 3.15.25 (Updated on Sep 2, 2025)

- Android Requirement: Android 6.0 and higher.

- Downloads: More than 10000000+ downloads demonstrating its enormous confidence and its popularity.

- Content Rating: Rated 3+. This makes it available to everyone.

- Offered By: FPL Technologies

The information provided shows that OneScore Score: Credit Score App is consistently updated extensively used and is maintained by a well-known business in the fintech industry.

Your Essential Financial Companion for 2025

The path to financial independence is built upon a base of discipline knowledge as well as the proper tools. The 2025 edition of The OneScore: Credit Score App has established itself as a vital tool to an Indian looking to gain charge of their finances.

It bridges the gap between awareness of credit and access to credit providing an effortless safe and powerful user experience. With its free lifetime access to CIBIL as well as Experian scores within an ad free and secure environment it has created an environment of confidence.

Through the use of powerful analytics powered by AI such as Score Planner and Simulator it empowers users to make informed decisions about their financial health. Score Planner and Simulator users are empowered to enhance their financial wellbeing.

By incorporating an open and immediate market for personal loans and a transparent personal loan marketplace you can ensure that the good credit habits you have are recognized by having access to money at the time you require them.

OneScore: Credit Score App is more than just an app. OneScore: Credit Score App is much more than just an application; it’s an investment for a more secure financially secure future for all.