intro

Hello everyone. In this post, Aura Gold. I am going to share with you complete details about such a digital gold saving application.

About aura gold

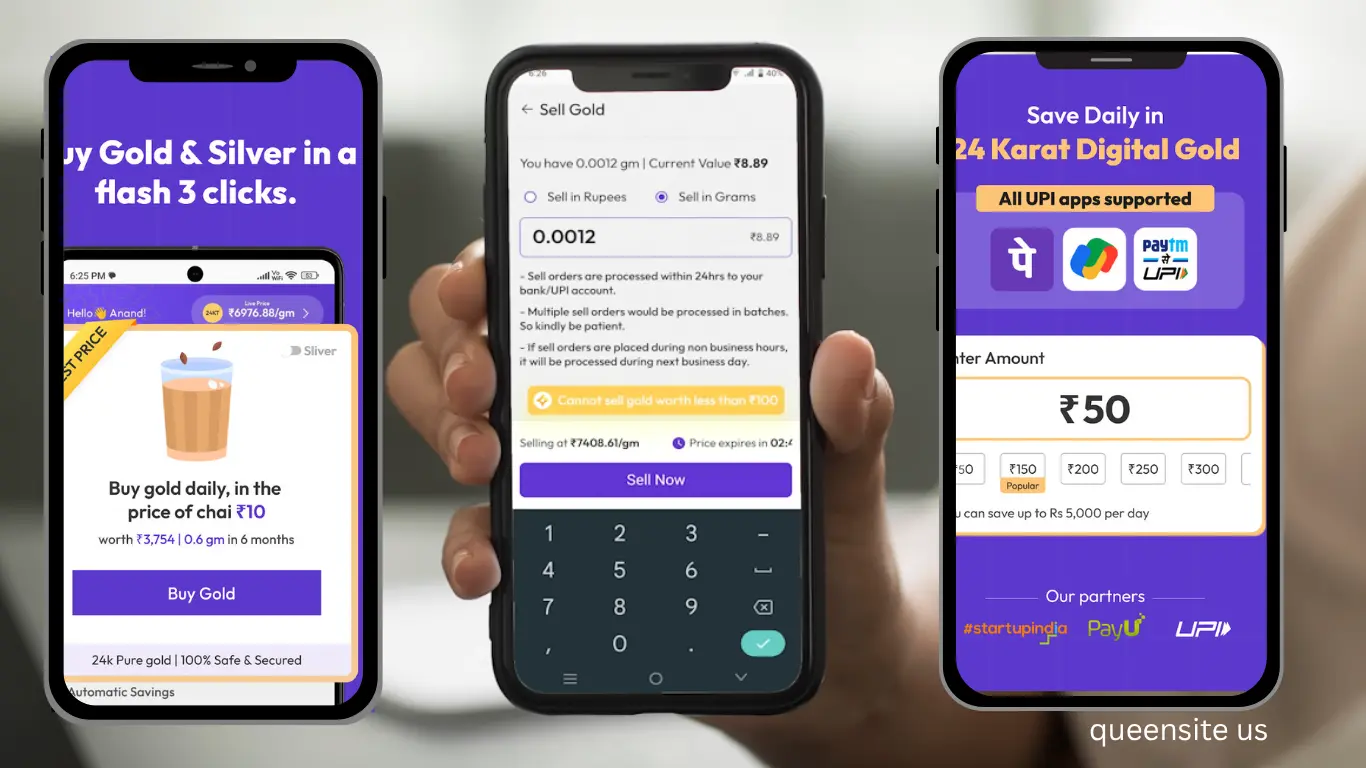

They say that you can invest in gold even with the money you spend on a cup of tea using this Aura Gold digital gold saving application. Yes, even if you have ten rupees, you can invest in gold with you.

Identity verification

Okay, they said that you can try it and see if it is worth the money you spend on tea, so why not install this Aura Gold app and create an account? They asked for our PAN card details after asking for identity verification. After entering all that and completing the identity verification, we can invest in gold.

Buy at the real-time gold price

So when you go to invest in gold, you can buy your gold for that period, whatever the live gold price is at the time you are going to invest. Now you are a jewelry store. No, when you check all the other websites. Most of them update the gold price only once a day. But they say that we will update it in real time as the gold price changes. So, whatever the gold price is at the time, you can buy it. You can invest in your gold for that period.

Manual and auto investment in gold

You can use the amount you have. There is a manual option where you can open the Aura Gold app daily, once a week, or whenever you feel like it and invest. Otherwise, they have given an auto option for everything to happen automatically. By enabling this autopay option, Daily will take a certain amount from your account and automatically invest it in the gold available in the app. You can set this amount from a minimum of Rs. 50 to 5000.

Refer & Earn

All the futures available in this Aura Gold app are very interesting to you. If you think that, you should let others know about this too. Don’t just let them know; use the referral code. Yes, you have given an option to refer and earn money to those who do not know your friend Go. Tell them about this Aura Gold app and create an account on this Aura Gold app through your referral code. Then they create an account on that app through you. They make a minimum transaction of 500 rupees. They have told you that you and they will be given ₹30 worth of gold on this Aura Gold app.

My investment experience

Okay, I invested ten rupees in this Aura Gold app, saying that we can also invest ten rupees with the money we spend on tea. Even though the amount I invested was ten rupees, you sent me an invoice for it. I only found out when I checked the invoice. They said that our government had said 3% GST. They said that the remaining amount of 9.71 had been credited to the account. When I checked my account, I found that I had earned only 9.07 rupees, which is almost a 64 paise difference, probably due to the price change of gold.

That is why I am earning this difference, so I checked the price with the temple. When I make a gold purchase, the price is the same as it was. But there is this difference. I don’t know why this difference has come about. If anyone from the Support Aura Gold team is reading this post, then tell me in the comments. Why has this difference come about? In the old video, we had asked for a cost like this. What did the sixth team say about it? If so, the gold work will cost 8,000.

Then the value of the gold that you can buy is ten rupees; according to the industry standard, the gold value can only be maintained up to four designs. The majority is maintained by just two decimal places; we maintain up to four designs. When we maintain like that, when we buy gold for a very small amount, the accuracy suffers. That is why there is this difference. When you invest in gold for a little more, there will be no such problem. This should be understood simply.

If you go to a petrol pump and ask for petrol for 100 rupees, there will be no loss when you buy a liter of petrol. But that is the same as when you buy petrol for 100 rupees; there will be a small loss in your paisa account. Similarly, here too, when you buy gold for 100 rupees, there will be a small loss in your paisa account. But that’s why when you use this option to buy gold in your Gram account, you have no loss, and you can buy gold in the exact amount.

Explanation about price difference

I saw the option to buy gold. They said that you can check the option to sell gold. When you try to sell gold. They said that you can withdraw it only if you have a minimum of 100 rupees of gold in your wallet. You can use this option to sell gold and withdraw the gold you have and withdraw it as cash. Otherwise, they gave you the option to make it ready as physical gold.

When you go to the selling option. When I buy, I can only sell a gram at a price that is 150 rupees less than the price of a gram. When I ask them why this difference is like that. They say this is the spread. That is, if this spread is like that, then there will definitely be a difference in the price at which you buy and the price at which you sell it, no matter what the product is.

For example, there are a lot of tamarind trees near our village. When the owner of that tamarind tree collects tamarind, processes it, and sells it to a trader who can buy tamarind.

Selling gold for money

When that tamarind trader asks someone who does not have a tamarind tree to go to the same tamarind trader and ask for a kilo of tamarind, there will definitely be a difference in the price at which they can sell it. If we sell any item at the purchase price, then we will not get any profit from it, so if that happens, they will definitely increase the price. I think they are doing the same thing. Not only that, but they are saying that this spread also affects a few other reasons.

You can also compare this digital gold saving application with Sprint; if not, go to an offline store and see the difference between the price of selling gold and the price of buying it, you will know

Redeem physical gold

If you are redeeming physical gold, then you can get ready with a minimum of 1 g to 10 g of 24-carat gold. When you get ready, the amount of gold you can redeem is your life, so enable this option and get ready. If you redeem it, then they will not detect any GST. But if you do not enable that option and get ready, then get ready. This amount will be taken directly from your bank account, and then when you take it, they will charge you 3% government GST.

For example, you have already invested one gram of gold in your wallet. When you invested like that, GSTR would have charged 3%. Now when you try to make that investment physically ready, you don’t need to pay any GST for making one gram of gold ready. Because you have already bought it by paying GSA for 1 gram of gold. But that is what your wish is for: one gram of gold.

But when you redeem it, you say that you will make two grams of gold coins ready. How do you redeem one gram of gold, one gram of gold, and one gram of gold from your wallet? The remaining one-gram amount will be withdrawn from your bank account. They will charge GST only on the amount that can be withdrawn. Then you have to get the physical gold ready.

Delivery charges

They say delivery charges are Rs. 300 per gram. They say that as the weight of the gold increases, this delivery charge will increase. When I asked why they are charging Rs. 300 for delivery, they said that they have added an insurance amount along with this delivery charge.

When I asked what insurance is applicable and asked for details, what did they say? That is, they take your gold from your wallet. On the way to bring it to your house, it will not be possible to deliver it. No, if it is damaged, then they say that we are buying this insurance amount to replace it with a new coin without taking any amount from you.

Must take unboxing video

If you are buying physical gold from this Aura Gold app, then definitely take an unboxing video when you open the package. Because in the future, if you say that you are going to a branch, if that unboxing video is not there, then they will reject it.

About profit

You see gold as an investment; invest in it now and sell it when the price increases in the future. If you are thinking of cashing it out, remember one thing: when you buy it, the government will impose 3% GST, and there will be a difference between the purchase price and the selling price. You will get a profit by crossing all of this, but it will take some time. But since the gold price has increased recently, you can get a profit soon even if you do not invest now.

But it will not always be like this. So, consider this as a long-term investment. Without all that, invest in gold now, and I will change it in the future. If you were in that mix, then. You can repair a jewelry box, but if you ask me if you can invest ten rupees, twenty rupees, or thirty rupees in a nail box, then I’m telling you. You can use this Aura Gold app and invest a small amount and convert it into a gold coin and buy it with that gold coin.

My opinion

Even though there are so many things, I will tell you my opinion. I have invested in this Aura Gold app myself. But before I invested like that, I checked the price of gold at online stores. Not only that, but I also checked the online store. When you check the online store, you can buy it as gold on the site where you can check it. Because it is right that you check the gold price on that site where you can buy gold. Compare the gold price and the price of the bread and decide which one is best for you.