Intro

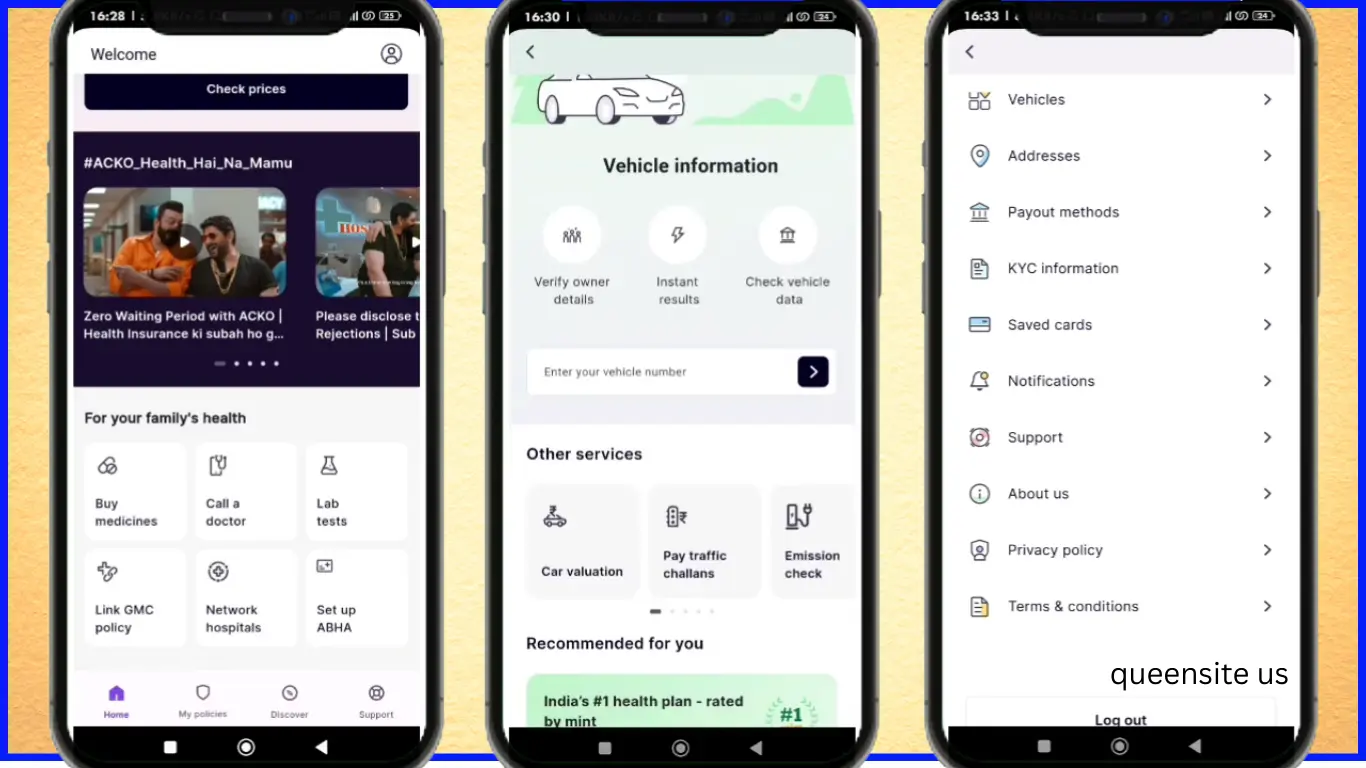

Hello everyone, Today in this post I am going to share with you a complete list of insurances that Acko Insurance can provide. They provide your health insurance, bike insurance, and car insurance.

Why do we choose Acko insurance?

There are many companies that provide all this insurance. Why should we choose Acko instead of that company? They have given some answers for that. Generally, we apply for insurance ourselves, so we do not do it directly. We apply for insurance through a middleman like an agent. By doing this, it will be like the agent giving a certain amount of commission from our bad premium amount. Due to this, the premium amount we can pay will be a little higher.

But as far as Acko Insurance is concerned. Their insurance is sold directly to the customer without any middleman. They say that they can cut the commission to be paid to the middleman and provide insurance at a lower price. Not only that, but this is a fully online process, so you do not need to fill out any papers to apply for insurance.

Claim process

If you think that you need to claim such an insurance application money in the future, then tell Acko as soon as you can. After you say that, they will ask you for a few documents depending on the policy you are thinking of claiming. It will be like you take a photo of all those documents and send them to them. When you send a climax request, you are asking for a claim for small things, and that too for a small amount of claim. They will review your claim request quickly and add the amount they can give you to your account. But you are asking for a little bit of a big amount.

Your car was very badly damaged during the exams. You make an insurance claim for this car, and then they will send an independent surveyor. The surveyor will check all the running conditions of the car and report it to Acko Instants. They will check all the things they can say and then decide whether to reject your claim request, prove it, or approve it, and if so, how much they can pay for your claim request. This is something that can happen to insurance companies as well.

Claim settlement ratio

We should definitely see how many people ask for this kind of climate and how many people’s claim requests are approved. That is the claim settlement ratio, that is, as far as Acko Insurance is concerned.

They say that out of 100 people who ask for clemency, they approve the claims of 94 people and reject the remaining six years of clemency. You don’t have to believe this. If you check the negative reviews of the Play Store, you will know how many people they have rejected. This kind of rechecking is something that can happen in every company, but if we know why they reject it, we will not make the same mistake.

Not only that, but any insurance company will not approve all the claims that come to them as claims. If they do, then the company will go bankrupt. That’s why they only think about how they can reject them, without giving us any space for that. Even if we apply for a proper claim by providing all the documents they ask for, then they will have to approve our climate request.

Cashless garages & hospitals 🏥

When you make an insurance claim here, if you go to a hospital or garage that is connected to that insurance company, the insurance company will come there and pay you the amount that you can claim for the cost you can afford. The insurance company will send that amount directly to that hospital or garage. You only need to pay the balance amount. Otherwise, if you go to a place where they are not correct, it will be like spending your own money for the expenses you can afford. After you spend that amount, the insurance company will credit your bank account with the amount of insurance or claim that you can make.

When you hear this, the option I mentioned first seems to be the best option for you. If you look at it that way, the larger the network of a company, the better it is for us. If we ask for the list of garages that can be connected to the auto insurance network. There are a lot of garages in our network. We have too many garages that we cannot share with you.

They are saying that we cannot share it with you. No matter what they say, there are a few insurance companies that have more garages on their websites. If you enter our zip code, they will tell you what kind of garages are available near our location. But they have not added that option either. Oh, let alone that, when National Insurance, which has 900 garages, is making their garage list look so funny. Acko Insurance is not funny either.

My opinion

I will tell you my opinion that it would be better to apply for insurance through an agent. If you say that applying for insurance is easy, then you will be asked to clean it. There should be a person who asks you to apply for insurance yourself and clean it. Why do I apply for insurance directly to give them a commission? I will take care of the cleaning myself so I can buy a branch from them. If you have that kind of confidence, then take insurance through this Acko Insurance.