Find out everything you need to know about Navi: UPI Investments & Loans APK. This comprehensive 2025 review will cover its UPI payments as well as mutual fund investments.

In the age of digital revolution, the manner in which you manage your financial affairs has seen major transformation. The days of managing different applications for payment borrowing investments as well as insurance are fast being discarded.

Todays consumer wants an unifying seamless and robust platform that is able to satisfy all of their financial needs all under one roof. That is the goal of the financial super app and at the forefront of this across India can be Navi: UPI Investments & Loans.

The idea behind Navi was of reducing the burden of finance for one billion of people Navi is not just an app; its an entire ecosystem that is designed to assist you in the path to financial wellness.

Established in December of 2018 by the entrepreneur with visionary name Sachin Bansal who is the co founder and CEO of Flipkart as well as his business partner Ankit Agarwal. Navi Technologies Limited began with specific goal that was to make use of modern technology to simplify financial services inexpensive accessible and available.

What has come out of this endeavor is Navi the Navi: UPI Investments & Loans application that is plethora of financial tools which has already received more than 100 million downloads from the Google Play Store.

If you’re in the market to get fast UPI payment begin your journey to investing with two rupees or secure the cash you need in the unexpected or purchase your dream house or safeguard your loved ones with robust medical insurance Navi offers streamlined easy clear and user focused solution.

This article offers in depth look into each aspect of Navis Navi: UPI Investments & Loans Platform and explores its capabilities along with its advantages and fundamental philosophy behind it that makes Navi significant player within Indias fintech ecosystem.

The Genesis of Financial Revolution: The Story Behind Navi

In order to fully appreciate the value that this apps effects Navi: UPI Investments & Loans application you must first understand the concept of its creators. Sachin Bansals experience through Flipkart revolutionized Indias online shopping environment by focusing on customer service and advancing technology. When he left Flipkart Bansal turned his eye to new sector that is that was ripe for change that is financial services.

The financial sector in India although robust was frequently perceived to be complicated inaccessible as well as intimidating to individuals of all ages. It was filled with documents lengthy waiting times as well as hidden costs and generally absence of openness. For many millions of Indians getting the credit market launching an investment or even purchasing insurance was difficult undertaking.

Thats the issue which Navi was developed to fix. Its premise was to establish an enterprise that provides financial services starting from scratch using technology as its core. Instead of retrofitting technology into the existing systems that were in place Navi built new age technologically advanced infrastructure. This allows for unparalleled efficiency speed as well as cost effectiveness.

The benefits of which are passed on directly to the user. Navi: UPI Investments & Loans application serves as the main interface to this high-end infrastructure. It’s created to be simple to new user while capable of handling the wide range of financial needs.

The structure of the company can be seen as testimony to its visionary approach having distinct and regulated entities in each of the verticals: Navi FinServ Limited for loans (an RBI registered NBFC) Navi General Insurance Limited for insurance (IRDAI registered) and Navi Mutual Fund to invest (SEBI registered).

This compliance with regulations guarantees that the customer experience is easy and contemporary while the backend operations conform to the strictest standards of security and accountability laying an environment of trust for users of the Navi: UPI Investments & Loans system.

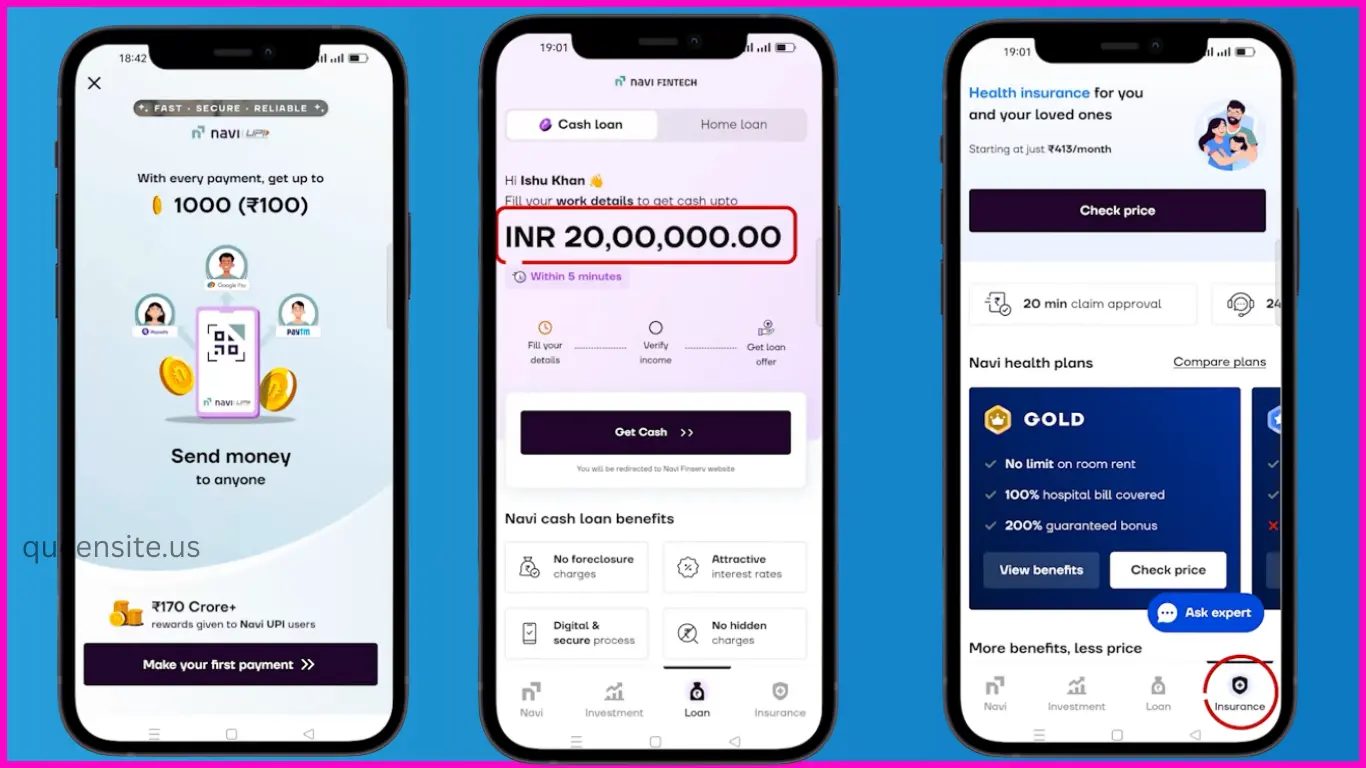

Navi UPI: Redefining the Speed and Simplicity of Payments

The UPI or Unified payments Interface (UPI) is the foundation of Indias digital payment revolution. The UPI capabilities in Navis Navi: UPI Investments & Loans application is masterpiece in its implementation. It has been approved by the National Payments Corporation of India (NPCI) Navi UPI is not just an added on Its fully featured sturdy reliable and rapid payment platform designed to withstand the demands of everyday life.

Core Features of Navi UPI

- Instantaneous Money Transfers One of the main benefits offered by UPI is that it can pay and get money immediately all day every day all year. Navi UPI is able to do this perfectly. When you have to transfer money to your personal bank account of relative as well as pay the local stores owner kirana or even split the cost of meal with your fellow diners its breeze. You only need the persons UPI ID or mobile phone number. This function makes Navi: UPI Investments & Loans app Navi: UPI Investments & Loans application in direct competition to payment applications that are standalone and has the benefits of connecting to the financial system of wider range.

- Complete Bill Payments and Charges: This app acts as central hub for your all recurring bills. It is easy to pay for gas electricity water broadband and water bills recharge mobile phone with prepaid credit or purchase the cost of your DTH subscription. This platform lets you create reminders or even automate specific payments making sure that you do not miss an deadline. It eliminates the necessity to navigate through multiple websites or use different applications for multiple charges.

- Universal Pay and Scan: Navi UPI fully is part of the QR code economy. It is easy to scan any UPI QR code and pay at thousands of restaurants stores and service providers throughout India to pay in flash. In app scanners are quick and efficient making payment faster as well as less hygienic than using money or credit cards.

- seamless online payments: While shopping online or with other apps for service Navi: UPI Investments & Loans is listed as payment option. It allows for safe fast checkout process with no needing to input the lengthy details of your card or bank passwords. It is authenticated right through your mobile which adds an extra layer of security.

- innovative Navi UPI Lite: Recognizing the necessity for more efficient lower cost payments Navi has integrated UPI Lite. It is basically an on device wallet that are able to preload as much as 22000 Rs. In the event of transaction that is less than 500 rupees you are able to pay directly through this wallet without having to enter an UPI PIN. This can be huge advantage for small frequent transactions like buying food drinks or for public transportation. This frees up your bank statements with multitude of entries and allows you to pay nearly instantaneous.

Integration of this strong UPI system creates Navi: Navi: UPI Investments & Loans application essential for everyday budgeting as well as gateway to customers to discover additional options on the platform.

Navi Investments: Democratizing Wealth Creation for All

In the past it was believed that investing was to be the exclusive domain of the wealthy or financially smart. The jargon and complexity the prohibitive entry requirements as well as the requirement for intermediaries kept the millions of prospective investors from being able to invest. The investment segment of Navi: UPI Investments & Loans application was designed to break down those barriers by offering easy clear easy to understand and easily accessible options for creating wealth by investing in mutual funds or digital gold.

Navi Mutual Fund: Investing Made Simple and Cost Effective

Navi Mutual Fund, which is that, is registered in the Securities and Exchange Board of India (SEBI) and has established niche it by investing in the passive index fund market through direct strategy. This approach is created to increase return for retail investors.

- Concentrate upon Direct Index Funds: Index funds are an investment type which aims to duplicate the markets performance index like that of the Nifty 50 or the S&P 500. Instead of picking stocks the fund manager invests in the same stocks as an index in similar amount. This method of management is passive and is great way to reduce expenses for managing. In addition Navi offers these as “Direct” funds. There aren’t broker commissions or distributor commissions associated with. combination of the passive approach to management with direct investment plan leads to an expense ratio that is lower which refers to the annual cost that the fund charges. Long term just tiny difference in your expense ratio could result in significant increase in your total corpus which makes Navis plans appealing.

- one of the lowest Cost Ratios This is Navis largest competitive advantage in the market for mutual funds. With constant emphasis on the latest technology in order to improve efficiency it is Navi: UPI Investments & Loans Navi: UPI Investments & Loans Platform has the ability to provide fund with expenses which are among the best within the field. commitment to cost effective investments guarantees that more of the money you invest is working to benefit your benefit.

- Flexible and Ultra Highly flexible SIP options: The Systematic Investment Plan (SIP) is the most sane way to make investments. Navi: UPI Investments & Loans app Navi: UPI Investments & Loans application gives you the most flexibility. It is possible to invest in weekly daily or on monthly basis. This can be particularly helpful for people with variety of earnings streams such as gig economy or freelancers and allows them to invest tiny amounts of money whenever they’ve got cash surplus.

- Open to All (Investment begins at the price of Rs100): Navi has decreased the threshold for entry to just Rs100 for mutual fund investment. This feature is game changer in democratizing access to the stock market giving students those earning low incomes as well as investors who are new to the market get started on their path to financial success without requiring huge starting capital.

- Superb Transaction Efficiency Navi has made improvements to the process of investing to speed. You are able to make investments till 3 pm in day that is trading and still receive the exact Days Net Asset Value (NAV) and get the days performance in the market. In addition Navi boasts one of the fastest payouts for redemption orders that you can find. If you choose to dispose of your unit of funds and receive the proceeds to the bank account swiftly offering an excellent liquidity.

It is essential to be aware of the typical disclaimer: Mutual fund investments can be risk to the market Read all the scheme related documents before investing. However, the Navi: UPI Investments & Loans platform excels at making it easier to use and reduce costs involved with the process.

Navi Gold: Modern Shine on Traditional Asset

Gold has always had an important position within Indian families as source of worth. Navi Gold modernizes this tradition with 24karat gold that is digital and 99.9 percent purity.

- accessibility and purity: You can start investing in digital gold of high purity for as low as 50 rupees. Micro investment lets you collect gold in systematic manner without having to worry about the bulky ticket size needed to purchase physical jewelers or coins.

- Secure and Convenience: Digital gold eliminates any hassles that come with physical gold including storage worries security threats storage concerns as well as cost of insurance. The gold you store is safe inside vaults that are insured with custodian who is third party. It is possible to buy or trade your digital gold immediately through Navi: UPI the Navi: UPI Investments & Loans application 24 hours day and at real time prices.

- Effective: Unlike physical gold and silver there aren’t any costs when purchasing digital gold. This makes it an effective investment option for people who are only interested in exposure to this asset category.

Navi Credit Services: Instant and Transparent Loans

The ability to access credit in timely manner is an essential element of the financial empowerment. Navi FinServ Limited significant systemically important Non Deposit taking NBFC that is registered with the RBI that is the sole provider of lending services for Navi: UPI Investments & Loans. Navi: UPI Investments & Loans application. The whole lending model is based on transparency speed and an entirely digital user experience.

Navi FinServ Cash Loan: Your Financial Safety Net

It is fact that life can be unpredictable, and financial disasters could strike at any time. Navi Cash Loan is Navi Cash Loan is intended to serve as an affordable source of money to help in these situations and also for pre-planned expenses such as weddings trips and home improvements.

- Substantial Loan Amounts It is possible to get an immediate personal loan between Rs.20 and 20 lakhs and cater to vast variety of financial requirements.

- Flexible and transparent Interest Rates The rates of interest vary between 12.06 percentage to 26% per year. The amount offered is contingent upon thorough credit analysis of the person applying. The app provides transparency on all fees including The Annual Percentage Rate (APR). This is the real amount of the loan since it comprises the interest rate and any processing costs which gives you an accurate understanding of the amount that your actual cost of borrowing will be.

- flexible repayment terms The borrower can select an appropriate loan duration that fits their ability to repay with the options from 3 month to longer 84 month period. This allows you to handle your EMIs effectively without stressing your budget for the month.

- An entirely digital journey: This is where the Navi: UPI Investments & Loans application really excels. The entire process of applying for loans all the way from beginning to end it is entirely paperless and occurs inside the application. The process involves filling out quick online application form electronic KYC confirmation and quick eligibility test. After approval the loan amount will be deposited directly into the bank account of your choice usually in just few minutes. Its far cry to the long days or weeks required to have the loan approved via conventional channels.

- Easy Eligibility: It is open to all segments of people and has an income threshold for households that is just Rs 3 Lakh annually.

Example of Navi Cash Loan:

For better understanding of the transparency let’s take look at this example

- Loan Amount: Rs30000

- Ratio of Interest (ROI): 18 percent annually

- Loan Tenure: 12 months

- Equated Monthly Instalment (EMI): Rs2750

- Total Interest Payable: (EMI x Tenure) Principal = (Rs2750 x 12) Rs30000 = Rs33000 Rs30000 = Rs3000

- Total Amount Payable: Rs33000

This straightforward breakdown will help users know the precise price of the loan prior to when they sign. Navi: UPI Investments & Loans app Navi: UPI Investments & Loans application makes sure there aren’t any unexpected costs.

Download

Navi Home Loan: Making Homeownership Reality

The purchase of house is one of the most important financial goals for majority of Indian families. Navi Home Loan aims to make this journey easier through its quick easy affordable and low-cost home loan service which is being offered in major cities such as Bengaluru Chennai and Hyderabad.

- Higher Loan Value as well as LTV Navi provides substantial mortgages for homes up to five crores. It also offers an up to 90% Loan to Value (LTV). The borrower just has to make down payment of 10 which makes it much easier for those who are first time home buyers to get into the real estate market.

- attractive interest rates as well as long tenures: With rates of up to 13% and tenures lasting as long as 30 years customers can get an interest rate that is both comfortable and viable over the longer term.

- zero processing fees This is groundbreaking aspect of the home loan market. The traditional lenders usually require processing charge which can amount to substantial proportion of the loan. In removing this cost Navi offers substantial savings for homebuyers.

- Astonishing Speed: Leveraging its technology platform Navi can provide approval letter in the span of just 5 minutes from complete the application form in Navi: UPI Investments & Loans. Navi: UPI Investments & Loans application. This speeds up the stress and uncertainty that comes with the approval of home loan procedure.

Navi Health Insurance: Your Shield Against Medical Uncertainties

Healthcare costs are rising and is huge financial risk for families. An emergency hospitalization can ruin years of savings. Navi General Insurance Limited affiliated with the IRDAI provides comprehensive and affordable health insurance via an app called Navi: UPI Investments & Loans application.

- Massive coverage: Navi offers health insurance plans that cover total amount covered of up to astounding Rs3 million. The coverage offered by Navi is high. provides complete peace of mind as it protects yourself and your loved ones from the financial burden of the most serious ailments.

- Affordable Costs: The plans are intended to be affordable and affordable starting with only Rs413 month (this is an estimate that is based on the health condition age and the protection).

- Large Healthcare Network: Navi has an expansive network of more than 12000+ hospitals throughout India. The policy holders can take advantage of settlements for claims that are cash free which means that the insurance company will pay the bill directly to the hospital. You do not have to cover the cost out of the pocket (up to the limit of your policy).

- Lightning Fast Cashless Claims If you’re in situation of health emergency the very most important thing to avoid is lengthy claims procedure. Navi claims that it will settle your claim cashless within 20 minutes in hospital networks. It is major difference drastically less stress at trying moment.

- 100 bill coverage and paperless Procedure: The policies are created to provide the complete coverage for hospital charges (subject to conditions and the amount of the insured) which means there are no surprise financial charges. All the way starting with the purchase of the policy and filing claim is entirely paperless and is managed via an app called Navi: UPI Investments & Loans application which reflects the brands digital first approach to business.

Seamless User Experience and Robust Platform

Financial apps that offer numerous services can get confusing and cluttered. But the Navi: UPI Investments & Loans application is well respected for its simple as well as friendly interface. Its navigation is clear, and each feature is clearly separated. The process of onboarding is straightforward, and the online KYC is quick and easy.

The performance statistics of the app will speak for themselves. With more than 100000000 downloads rating for content for children aged 3+ as well as regular update (the most recent being version 5.48.2 20th August 2025)

This is an established stable and well-maintained system. It runs on Android 7.0, and above which makes it suitable for wide range of the smartphones used in America.

The huge number of users an indication of the reliability and trust Navi has earned over time. Navi: UPI Investments & Loans application has gained over the course of time.

Sharing and Earning: The Navi Referral Program

Navi is encouraging its happy customers to be brand ambassadors by introducing referral program. When they share an exclusive referral link with relatives and friends’ customers are able to earn exclusive rewards with each successful referral. The reward could be discounted rate on loans cash back bonus or additional rewards. The program can create spiral of growth and rewards faithful customers who spread the word about the many benefits of Navi: UPI Investments & Loans ecosystem. Navi: UPI Investments & Loans network.

The Bedrock of Trust: Safety Security and Regulation

In the world of money, the trust factor is unavoidable. Navi has constructed its entire business model with strong foundation built on safety and compliance with regulatory requirements. Every single one of Navis business segments is overseen by one of the top authorities in India:

- Loans: Navi FinServ Limited has been registered and regulated by Reserve Bank of India (RBI).

- Insurance Navi General Insurance Limited has been registered and regulated by Insurance Regulatory and Development Authority of India (IRDAI).

- Mutual Funds Navi Mutual Fund is licensed with the Securities and Exchange Board of India (SEBI).

- UPI: Navi UPI is certified by the National Payments Corporation of India (NPCI).

The approvals do not just serve as formalities they’re an assurance that Navi is strict adherent concerning data security client privacy financial transparency and ethical methods.

The application itself is equipped with state-of-the-art security protocols and encryption to secure user data as well as financial data making sure that all transactions through Navi: UPI Investments & Loans platform is secure and safe. Navi: UPI Investments & Loans system is secure and safe.

Future of Finance is Here

Its Navi: UPI Investments & Loans application is not just the collection of financial products and services; its carefully developed ecosystem that is designed to address all aspects of the individuals’ financial demands.

It’s an impressive example of how technology can be utilized to eliminate obstacles and build broader financial ecosystem. From the simple everyday UPI transaction to the huge effect of getting the medical insurance or home loan Navi provides single solid trustworthy and clear platform.

It is great solution to eliminate the need for multiple apps and provides an integrated perspective of your financial situation. constant emphasis on paper free fast and mobile first user experience is able to cater well to the demands of the new generation of digitally savvy customers.

With it’s easy to pay system as well as investing easy credit readily available and understanding insurance The Navi: UPI Investments & Loans platform does not only provide solutions but also creating financial security and helping thousands of Indians to control their future.

If you’re looking for one app that will help you to streamline the management control and growth of your finances, then you’ve come to the right place. Install this app Navi: UPI Investments & Loans application to unlock an array of options for financial security.