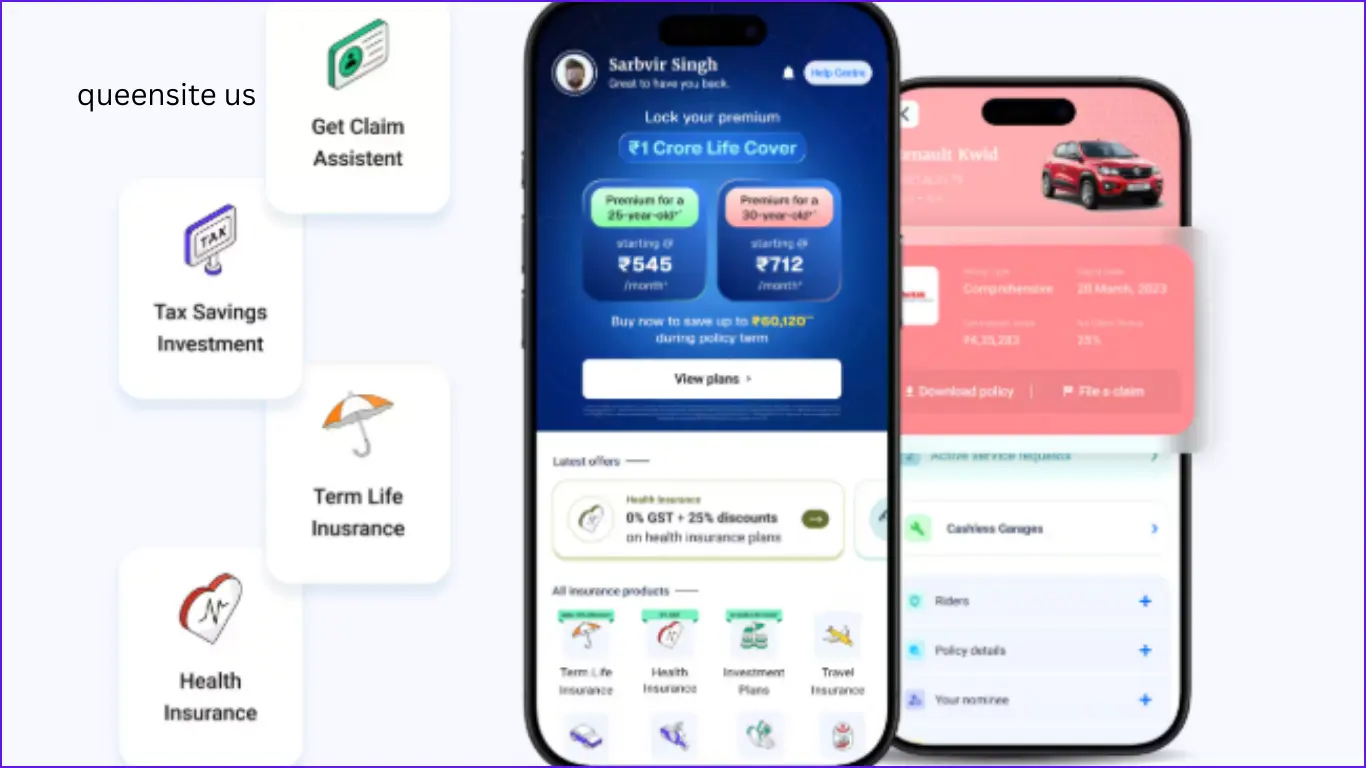

Hello everyone, Policybazaar.com. You can use this platform to compare insurance policies from many companies and choose the one that suits you best. In this way, I will share with you my opinion about this policy bazaar along with the advantages and disadvantages of using this platform to get an insurance policy.

Policybazaar Insurance Review: Advantages

Let’s look at some of the advantages of this:

- This policy bazaar provides you with many types of insurance.

- You can compare insurance policies from many companies in each category.

- When you compare, the price of the policy you can get on the policy bazaar is often cheaper than its offline price.

- But if there is a price difference, do not take any policy without knowing the information about that policy and reading its terms and conditions.

- Then you can use this platform and take an insurance policy online, so you do not have to call an insurance agent and ask him to come to your house; otherwise, you do not have to go to his office.

- But check that all the details you enter are filled in correctly.

- Generally, the customer support of this type of online platform is very, very important.

- Their customer support is very good in that way.

- They call you while you are looking at a policy on their website.

Policybazaar Insurance Review: How It Makes Money

If you have any doubts about that policy, they will answer you clearly when you ask them.

- Apart from this, there are not many advantages, so let’s take a look at our direct disadvantages. Before that, let’s know how this policy market makes money:

- You don’t need to pay any amount to use this policy market.

- But when you purchase a policy using this platform, the insurance companies will give a small amount to the policy market.

Not only that, but they have said that they get paid by the insurance company for recommending and advertising certain policies to users. This is how Policy Bazaar makes money.

Now, let’s look at some of the possible disadvantages of this platform:

- As soon as you give your mobile number to this Policy Bazaar to find out about a policy, they will start calling you.

- No matter how much they call and help you, they will try to sell you their policy anyway.

- So, if you are 100% using Policy Bazaar and buying a policy, sign up with your mobile number.

- If not, do not create an account on this platform by giving your personal mobile number for any reason. If you do, see for yourself how many calls you get.

- If you are going to use this platform and take a policy, they do not know many things about you personally, so they will not recommend you based on which policy is right for you.

- They will recommend you based on which policy they get a lot of commission from. This is something that can happen everywhere.

👉“Check our guide on savings schemes in India for more financial planning tips.”

What do you say? Are we going to compare all the policies ourselves? Then how can we cheat? If you ask, all the policies of a few good companies are not available on this website. It would be better for you to compare and buy that policy too.

We should never forget why we take a policy:

- We take a policy only to make a claim if something happens in the future.

- It is not enough to see if it is easy to take such a policy, but we should also see if it is easy to claim it.

- In that way, the work with them is over when they sell you a policy in the policy bazaar.

- After this, if you go to claim, they will ask you to contact this insurance company.

- You can only claim by contacting them and following the rules they tell you.

- But many people have mentioned in their reviews that claiming like this is not as easy as getting a policy.

So you said that the customer support is great? If you said that we will see about it, then the customer support is great not only before the sale but also after the sale… (Sound of the phone disconnecting).

Despite all these things, I will give my opinion:

- For me, we will only claim our insurance in a critical situation.

- In that case, it would be very good if our agent, who we are already familiar with, helped us. That is my opinion.

Why are they helping for nothing? They get a commission from the premium we pay, that’s why they help. There is no need to take money and help us; they give us policies at a cheaper price in the policy bazaar and we go there and buy them, so if you said that, you could go and get a policy from the policy bazaar.

But once you go and claim, you will not go to the policy bazaar again. You should definitely apply through an agent. When you apply like that, it would be better to apply for insurance through a friend, relative, or a trusted person who is familiar to you.

I have a friend of mine, and there must be someone in your circle of friends like that. Thank you and greetings.